LATEST NEWS

Bookkeeping AND Accounts Hints AND Tips

3 March 2025

A common error that occurs when running a business is that many business owners do not invest in a bookkeeper until it is too late. This can become most costly that it would have been if they had invested from the beginning, allowing the experts to grow with their business. Start-up businesses may seem simple to keep on top of when it comes to bookkeeping, but bad habits form quickly and are hard to break. If you can relate to just one of the following signs; your business is in need of a bookkeeper. Pronto! 1) You’re behind with your lodgements to the ATO Overdue lodgements with the ATO can quickly accumulate and wreak havoc on a business. Not only will the ATO impose late lodgement penalties, but as soon as your lodgements are up to date you will be left with a hefty bill to pay which will also be incurring General Interest Charges. Falling behind with your lodgement obligations with the ATO can also have a negative impact on your borrowing abilities with Financial Institutions as well as with your cash flow. 2) Your businesses account keeping isn’t in a Cloud Based Bookkeeping System It’s 2021! Gone are the days of pen and paper and ledger notebooks. If your accounts still aren’t being prepared in a live cloud based bookkeeping system, you’re behind the times. It’s just that simple. 3) You have overdue Debtors and Creditors Not being able to meet your payment due dates as and when they fall due is a very bad sign and is usually mostly cause by poor cash flow management and/or bad Debtors. Are you aware of who still owes you money, how much, and when their accounts were due? If you answered no, you seriously need to give us a call. Leave the hard yards to us! 4) Your businesses paperwork is a mess Filing systems are everything, whether they are electronic or physical. If point number 2 didn’t hit you in the feels, maybe this one will. Are you uploading and attaching your electronic documentation to your bank transactions, accounts payable and accounts receivable in your cloud based bookkeeping system? You should be. Not only is this an awesome way to store documents all in one place, and accessible from any device, but it reduces the number of queries from your Tax Agent at tax time. Everything is right there! 5) You are constantly misinterpreting reports and your financial position Do you actually know the difference between and Profit and Loss Statement and a Balance Sheet? Do you understand what the Balance Sheet is showing you? Are you allocating transactions correctly so they are being reflected in the correct reports? If you cannot confidently answer any of these questions with a solid “YES!”, chances are the answer you are looking for is a big fat “NO!”. Bookkeepers are experts at knowing what transactions need to be reported where, which types of payments are to be posted to an expense vs. liability and what is an allowable deduction and what is not. We have spent., and continue to spend, years becoming educated, qualified and insured so that your business can get it right. There are many more signs that would indicate that your business would benefit from hiring a bookkeeper, but these are the most common that stand out. If these points resonate with you, give us a call. We’re your perfectionist in bookkeeping. Let us help your business get it Exact!

3 March 2025

Generally, an employee preforms work under the direction and control of their employer on an on-going basis. The employer determines the hours, work location and how the work is done. Independent contractors run their own business and provide agreed services under a contract for those specific services. They control the hours required to do a task, and has control over the way they work to complete the contracted services. Here are some key differences between an Employee and a Contractor : Working Hours Unless you are a casual employee, employees have regular and defined working hours. On the other hand, contractors usually have the freedom to decide what hours they work to complete the task unless otherwise specified in their contractor agreement. Control Over Work Employees typically work under the standards and directions their employers set out for them. Conversely, contractors have a high degree of control over how they complete the work. Commercial and Financial Risk Employees face no commercial or financial risk over the work as it is the employer who bears the responsibility. Contractors assume the risk of making and losing money and are responsible for any liability or defects. As such, contractors are generally required to have their own insurance. Work Expectation Employees, including some casuals, can expect regular and systematic work. Contractors are usually hired for specific tasks and may or may not be engaged for further work. Payment Employees receive payment in a routine manner whether that be weekly, fortnightly or monthly. The payment is in exchange for time. In contrast, contractors are paid for completing work which they have quoted. They are paid through invoices and maintain an ABN. The payment is in exchange for achieved results. Equipment and Tools Employees will benefit from their employers providing them tools and equipment, or at the least, an allowance for them. Contractors have the responsibility of supplying their own equipment and tools to complete the work. Superannuation Employees are entitled to superannuation payments (which their employer pays) to their nominated super fund. In most cases, contractors will have to manage their own superannuation payments. Tax Most employees have their tax deducted through arrangements like pay-as-you-go (PAYG). Contractors have to pay GST and make recurring tax payments to the Australian Tax Office. Leave Entitlements Employees have the benefit of leave entitlements (e.g. annual leave or carer’s leave). Casual employees receive a loading instead of these entitlements. In contrast, contractors receive no leave benefits. Visit the ATO Website to find out whether your worker is an Employee or Contractor for tax and super purposes.

3 March 2025

There is often a misconception that bookkeeping and accounting are the same thing. While they both work to assist you with your finances, there are some important distinctions between the tasks of a bookkeeper and an accountant. It is important to understand that both bookkeepers and accountants are integral parts of your business. While their tasks can sometimes overlap, there are definitely certain aspects of your business that you would specifically entrust to an accountant, and others that you would give to your bookkeeper. In simple and very general terms, a bookkeeper will be the person that assists you with the ongoing financial recording and transactions that keep your business running smoothly. Your accountant, on the other hand, will be the person who analyses the data produced by your bookkeeper, reports on it, and is best suited to give you financial advice. Your accountant will also have a strong understanding of your taxation requirements, and will be best able to assist in that area. Some tasks that are regularly undertaken by your bookkeeper can include: Processing invoices, receipts, payments, and other financial transactions Processing and maintaining your payroll system Preparing initial financial statements Reconciling accounts and preparing reconciliation reports Managing your accounts receivable and accounts payable, i.e. amounts owing by debtors, and amounts owing to creditors Calculating GST Preparing and lodging your BAS Designing, establishing and reviewing accounting systems There are a wide variety of other tasks that a bookkeeper can undertake, and much like the tasks outlined above, they are generally related to the ongoing maintenance of your financial records. While an accountant will also be qualified to assist you in these areas, it is important to be aware that there is likely to be a substantial difference in fees charged by bookkeepers and accountants. The role of an accountant in your business, will be in a position to offer financial projections and advice on future financial elements of your business through analysis of past performance. Accounting is more subjective, providing business owners with financial insights based on information taken from their bookkeeping data. They will prepare financial statements and complete tax returns, can undertake audits, and importantly, can help you to analyse strategic financial matters, like operating costs and forecasting. Further services offered by your accountant can also include: Taxation advice and planning Business establishment assistance Auditing Corporate reporting and compliance Superannuation fund advice Financial management advice While not an exhaustive list of an accountant’s services, the tasks outlined here serve to highlight the analytical and advisory nature of their position. Given that there are substantial differences between the services offered by bookkeepers and accountants, it can be seen that both are important to the growth of your business. Instead of viewing them in a ‘bookkeepers vs accountants’ situation, it is important to understand that your accountant and bookkeeper work best together to serve the financial requirements of your business.

3 March 2025

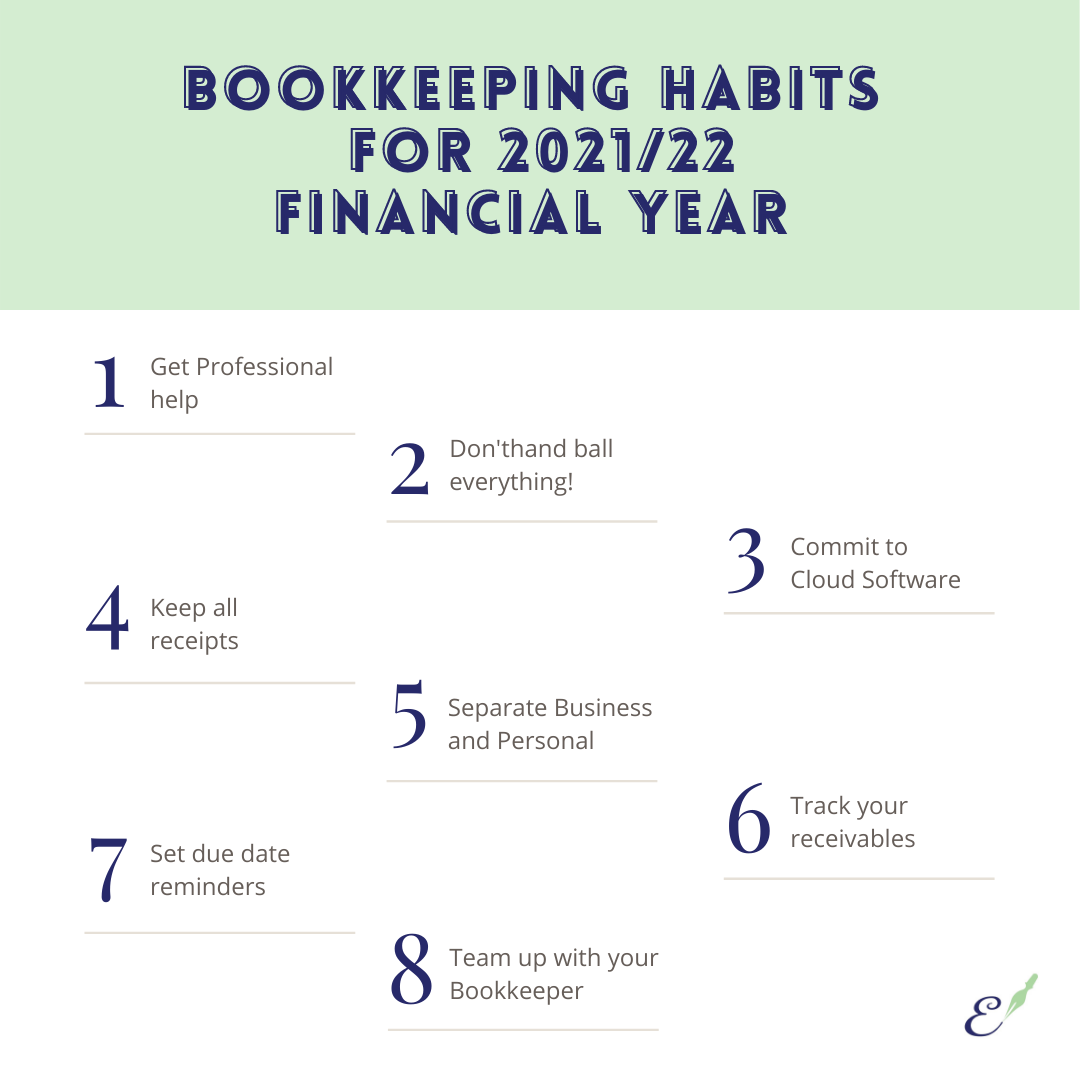

It’s not easy growing a business, and it’s not easy maintaining a business within the current circumstances we’ve faced over the last year, so pat yourself on the back as we wrap up the 2020/21 financial year and reflect on your business successes. It’s important for you to examine and fine-tune your finances to make sure you’re delivering in the best possible way. Poorly tracked finances can cause your business a world of problems, from poor cash flow to improper filings and beyond. These kinds of problems can put a business at serious risk. Good bookkeeping habits, on the other hand, can help a business thrive, not just survive. As the tax year rolls over we’ve put together some bookkeeping habits to implement into your business and manage the new financial year with confidence. Get professional help. Business owners are pulled in a dozen different directions. That’s why it makes sense to outsource work you don’t have the expertise or time to do. If you’re like many entrepreneurs, you likely went into business to pursue a passion, not to become a bookkeeper or accountant. Sometimes outsourcing the job to somebody who can do a quicker and better job is much smarter than trying to tackle it yourself. Professional Bookkeepers can do more than just ensure your paperwork is in order. They will be the person that assists you with the ongoing financial recording of transactions that keep your business running smoothly. They have a trained eye that can spot ways for your bookkeeping to be improved. Don’t hand ball everything. Outsourcing your bookkeeping doesn’t mean you should leave it entirely to somebody else. You’ll want to review reports, understand what’s happening with your business, and ask questions. No matter your level of expertise, it is beneficial to your business for you to understand as the owner some of the basic business numbers, including profit, trend in expenses, accounts receivable and more. You can use this information to monitor the health and growth of your business. Get the right software and Commit to Cloud. If you still haven’t made the switch to cloud accounting, the new financial year is the perfect time to take the plunge and get an online accounting software. Instead of countless spreadsheets and a shoebox full of receipts, streamline your business bookkeeping with cloud software. It will help you keep track of your finances and make it dead easy to share information with your bookkeeper, accountant and business partners. You don’t want to skimp on the program that you use, a good system is worth the investment. These days there are many different options out there, so look for a system that best meets your business needs, and one that you’ll actually use. Ask around for recommendations from friends who run businesses similar to yours. We personally LOVE Xero! It has live accounts, cloud storage, multiple currencies, automated superannuation payments and is super user friendly! Keep expense receipts. You can’t know how much you’re spending on your business if you don’t keep receipts. This is somewhat straightforward for electronic purchases, since you’ll have both receipts and monthly statements against which to check them. Where things can get tricky is if you aren’t careful with cash expenses. These receipts matter even more since there are no backup statements. Some people keep a small notebook with them to log cash expenses as they’re incurred. Better yet, use an accounting app on your phone to snap pictures of the receipts as you go! Consistency is key for good bookkeeping and it can help you spot errors later on. Keep Business and Personal Finances Separate. When you start your business, it may not seem like a bad idea to keep your business finances and personal finances in one account. However, it can quickly create many problems for your business. During the reporting period, for example, you have to review all your bank statements to make sure you have invoices for each payment you receive from a client/customer. In the case of a separate account just for business, it is easy to determine what expenses are incurred for business purposes, but when mixing personal and business transactions in the same bank account, it will result in a nightmare to understand which one is personal and which one is business. Track your receivables. It’s one thing to issue invoices, but it’s another to ensure your invoices are paid. Keep up-to date logs of your invoices and the status of each sent, received, paid, partially paid, and late. Some accounting softwares can even keep track of invoices and flag late and unpaid invoices to automatically send invoice reminders. Set Due Date Reminders. Dedicate some time in your schedule to handling your books, why not set some automatic reminders while you’re at it? Keeping on top of deadlines and due dates for things like filing dates, invoice due dates, and regular bill payments will help you better manage your cash flow and that means a healthier business. Work as a team with your Bookkeeper. Business owners often look at their Bookkeepers as just another expense, a trusted bookkeeper, however, can be a key ally in your business, It is important to understand that bookkeepers are integral parts of your business, helping to guide you to success and spot potential issues in the business before they arise. Think of your bookkeeper as a business partner, not just a money shuffler, and find someone who can offer insight into your business. A great bookkeeper can help take a business to the next level. The goal of these habits is to ensure you are always on top of your bookkeeping, that you’re organised and everything has been done correctly and on time. Even if you are several years behind, a bookkeeper can get your business back on track and provide basic training to ensure it stays that way. If the new financial year has you feeling overwhelmed, disorganised and just plain worried, your business might benefit most from outsourcing bookkeeping services, so let us work with you to develop and perfect good financial habits to implement into your business. Please don’t hesitate to get in touch, we can discuss your business needs and tailor a package that is right for you and your business.

3 March 2025

Thinking about hiring a bookkeeper for your small business or startup? Smart move. But money is often tight for tradies or sole traders, so the big question is whether it’s worth the extra expense, especially as the books are a cost most of us think we can absorb. Registered BAS agents and bookkeepers are legitimate ‘Number Whisperers.’ Having their eyes across your accounts will ultimately save you, not just financially but time, frustration, confusion, and even potential conflict. Do you want to tell your business partner the Ute has to wait? Your books tell a story that bookkeepers can read better than you, your partner or that generous mate could ever interpret. They are trained to clarify profit and loss statements, decode bank reconciliations, calculate payroll deposits and decipher tax returns to maximise your claims. And that’s just the beginning. Deep dive examinations of financial transactions or audits do not intimidate them. Their alphabet is numerical! Bookkeepers Make Sense Certified Australian bookkeepers can offer a multitude of services and management options and they know more than anyone - time is money. 1.Play To Your Strengths Whether you are in the throes of establishing a startup, pivoting to keep your small business afloat, or facing the inconsistency of tradie worksites in a COVID-normal world, more than likely you are completely absorbed in the day-to-day operations of your business, as you should be. At the end of a complicated and exhausting week, the last thing you want to think about is paperwork, balancing books, and stressing about cash flow. In this frame of mind are you really seeing the big picture? Are you getting a true sense of where you’re at, what needs immediate attention, and what’s coming down the road? Your bookkeeper can. 2. Respect Know-How Not many founders, bosses, or tradies have backgrounds in bookkeeping basics. They are experts in their own fields. Don’t you want that same level of expertise when it comes to your books? Consider the effectiveness of a qualified bookkeeper equipped with the latest knowledge, education, and technology to manage the financial side of your business. The stress of cash flow, payroll, and tax returns evaporate and you get back precious time and energy to focus on what you know. 3.Fresh Eyes On Your Prize We all want to believe we are objective when it comes to running our own business, however, a bookkeeper might be the impartial pair of eyes that your operation truly needs. Their objectivity across monthly reports, quarterly BAS, aged debt, or even debt collection might be the perspective that takes your business to the next level or prevents looming disaster. 4.Experience Equals Efficiency We all believe we’re going to pay suppliers on time, process that Carers Leave for the 2IC, generate and issue customer invoices… oh, and before logging off… update your brilliant new employee’s information! It can get overwhelming and the instinct is to put it all on the back burner. It just makes business sense to have a data-smart bookkeeper diligently working away in the background so there are no forgotten payments, no misallocation (or misappropriation) of funds, no surprise expenses. Nor do you have to stay up-to-date with the latest convoluted ATO practices as your bookkeeper will be 100% informed and compliant. 5. Work-Life Balance Don’t negate the blood, sweat, and tears that went into creating your startup or the job of your dreams because you had zero time to enjoy the life it inspired. Professional payroll services, small business invoicing management, or end-of-financial-year preparation and lodgement are just a few of the hassles that qualified bookkeeping professionals can resolve for you. Don’t drown in paperwork. Respect your efforts by enjoying the rewards. 4.Invest In Your Own Business All this expertise is within arm’s reach. Cloud-based accounting software means all you need is a phone and an internet connection and your bookkeeper does the rest. You don’t need to chase local bookkeepers as most are familiar with virtual environments. Bookkeepers are in the business of keeping you in business. They see your success as their success, so an investment in their services demonstrates an investment in your own business. We like those numbers.

3 March 2025

The dedication it takes to own and operate a small business is substantial, bordering on all-consuming. Herculean efforts go into providing the best products and services for your customers, in order to become sustainable. However, recognising (and reconciling) cash flow does not always get the attention it deserves, because balancing the books is not everyones’ forte... nor is it fun. Wait! There are unicorns in the professional sector called bookkeepers! People who genuinely love numbers, balance sheets, reconciliations, and payroll. I know! They are as passionate and tenacious about their business as you are about yours. Bookkeepers excel at the business side of your business. They pride themselves on making the most of your books, maintaining and reconciling your accounts, and capitalising your tax returns, so you can invest your time and energy elsewhere. The Devil’s In The Details Bookkeepers are not intimidated by your shoebox files or your wallet receipting system. In fact, they expect a degree of uncertainty or confusion from their clients who are unsure as to whether they are profiting, have good cash flow, need debt collection, or payroll services. They puzzle out these pieces of intel and make the best possible business picture for you. Outsourcing your bookkeeping will dissolve your pain points. With your accounts reconciled, invoices paid, your BAS statements lodged and your employees remunerated, you will be free of that hassle and turn your energy to more productive pursuits. Bookkeepers often offer insights into areas of your business that need improvement, are succeeding, or require a thorough rethink. They interpret granular so you see the big picture. Spend Money To Make Money Very few of us have the time or inclination to get the best out of our books. There are always exceptions to the rule, however, most of us need to be dragged kicking and screaming towards bank statements, balance sheets, and lodgement obligations. Professionals cost money and ultimately having an expert on board means saving in the long run; whether that’s time, money, headaches, or missed opportunities. Qualified bookkeepers typically find that needle in the haystack, that’s how their beautiful brains are wired - they’re driven to find the easiest, effective, efficient, and most elegant way to grow your business. And a quick word to the wise… don’t fall into the trap of getting your partner, neighbour, or friend to keep your books. The road to hell is paved with good intentions. Are they up-to-date with the latest technology and tax breaks? Are they really streamlining your operations? Are they growing your business or simply getting the job done? Hire a professional bookkeeper! An impartial eye is laser-focused. Bookkeeping 101 At the very minimum, if you outsource a bookkeeper they will prepare the following online documents for you with precision and accountability. BAS Preparation and Lodgement Accounts Payable Accounts Receivable Payroll Services Account Management Account Reconciliation Financial Reports and Statements EOFY Lodgements, such as TPAR and STP finalisation Even if you don’t need the full suite of services, simply outsourcing payroll for your employees can be a huge benefit and alleviate the stress of guaranteeing accurate, on-time deposits. It goes without saying, don’t mess with peoples’ wages. Certified bookkeepers’ attention to detail is unparalleled. Their business is to grow your business. As a wise bookkeeper once said, “You didn’t start a business to do bookkeeping, but we did!” That’s money!

3 March 2025

It's important that you finalise your employees' data by 14 July if you can, and let your employees know when you have so they can lodge their income tax returns. Making a finalisation declaration : Before making your finalisation declaration, make sure your STP information is correct. If you can't make a finalisation declaration by the due date, you will need to apply for a deferral. You can finalise your data earlier if it’s ready. The sooner you finalise your employees’ information, the sooner they will be able to lodge their tax returns. When you have reported and finalised your employees' information through Single Touch Payroll (STP), you are exempt from: providing payment summaries to your employees lodging a payment summary annual report. For payments to your employees that were not reported through STP, you still need to: give a payment summary to your employees provide us with a payment summary annual report for these payment summaries. What you will need to tell your employees: you are no longer required to provide them with a payment summary for the information you’ve reported and finalised through STP they can access their year-to-date and end-of-year income statement online through myGov or talk to their registered tax agent 'income statement' is the new term for their payment summary to wait until their income statement is 'Tax ready' before lodging their tax return to check their personal details and if necessary, update with both you and the ATO (incorrect personal details may prevent them from seeing their STP information) if they don't have a myGov account they can easily create one – see Setting up your myGov account. Employers with closely held payees : If you have 20 or more employees, you should be reporting closely held payees each pay day along with arms-length employees. The finalisation due date for closely held payees is 30 September each year. For small employers (19 or fewer employees) who only have closely held payees, the due date for end-of-year STP finalisation will be the payee's income tax return due date. For an employer with a mixture of both closely held payees and arms-length employees, the due date for end-of-year STP finalisation for closely held payees is 30 September each year. All other employees are due 14 July each year. If you need further information visit the ATO Website .

3 March 2025

WorkCover Insurance covers employers for the cost of benefits should an employee be injured or becomes ill because of their work. A business who employs workers must register for WorkCover Insurance in the state or territory in which they employ their workers. If a business employs workers across multiple states and/or territories, multiple insurance policies will need to be held to cover each state. Certifying your Remuneration Each year, a business is required to certify their remuneration. This means, they must report the total wages paid to employees, including superannuation and payments to rateable contractors, as well as estimate their wages payable for the coming twelve months in order to calculate their insurance premium. It is important that an employer keep an eye on their employees wages paid throughout the year as incorrectly estimating remuneration can result in large fines. An employer must revise their estimate change within 28 days to avoid penalties. For more information on Penalties for Underestimation of Rateable Remuneration, click here to download WorkSafe Victoria’s information guide. Inclusions and Exclusions As stated above, payments to some workers may not be included in your payroll, but must still be included in your remuneration calculation. What is Included? Salaries and Wages Contractors (to determined if your contractors payments are reportable for the purpose of calculating your remuneration, please see WorkSafe Victoria’s “ Understand if contractors are considered workers ” information page) Fringe Benefits Superannuation Commissions Some salary and wages paid to workers who work in more than one state of territory What is Excluded? Motor Vehicle Allowance Accommodation Allowance Apprentices or Trainees Compensation payments to an injured worker Termination payments If you are unsure how to calculate or lodge your certified remuneration, a BAS Agent or Tax Professional will be able to help.

CONTACT US

Can’t find what you’re looking for? Contact Exact BAS and Bookkeeping on (03) 9860 4480 today.

CONTACT INFORMATION

Phone: 03 9860 4480

Email: information@exactbas.com.au

Address: Melbourne

Registered BAS Agent with the Tax Practitioners Board and an Associate Member of the Institute of Public Accountants.

Xero Silver Partner and Certified Xero Advisor,

BUISNESS HOURS

- Monday

- -

- Tuesday

- -

- Wednesday

- -

- Thursday

- -

- Friday

- -

- Saturday

- Closed

- Sunday

- Closed

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy